A) perpetuity.

B) term.

C) maturity.

D) intermediation.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When the government budget deficit rises, national saving is reduced, interest rates rise, and investment falls.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following policy changes would lead to a decrease in the real interest rate and an increase in investment and saving?

A) a larger investment tax credit

B) an expansion of eligibility for Individual Retirement Accounts

C) an increase in income-tax rates, with no change in the government budget deficit or surplus

D) an increase in government purchases, with no change in taxes

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two bonds have the same term to maturity. The first was issued by a state government and the probability of default is believed to be low. The other was issued by a corporation and the probability of default is believed to be high. Which of the following is correct?

A) Because they have the same term to maturity the interest rates should be the same.

B) Because of the differences in tax treatment and credit risk, the state bond should have the higher interest rate.

C) Because of the differences in tax treatment and credit risk, the corporate bond should have the higher interest rate.

D) It is not possible to say if one bond has a higher interest rate than the other.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

World Wide Delivery Service Corporation develops a way to speed up its deliveries and reduce its costs. We would expect that this would

A) raise the demand for existing shares of the stock, causing the price to rise.

B) decrease the demand for existing shares of the stock, causing the price to fall.

C) raise the supply of the existing shares of stock, causing the price to rise.

D) raise the supply of the existing shares of stock, causing the price to fall.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about mutual funds is correct?

A) A mutual fund is not a financial intermediary.

B) A disadvantage of buying mutual funds is a lack of diversification

C) People who buy shares from a mutual fund are guaranteed a minimum return.

D) On average index funds outperform managed funds.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a government that taxed all interest income changed its tax law so that the first $5,000 of a taxpayer's interest income was tax free. This would shift the

A) supply of loanable funds to the right, causing interest rates to fall.

B) supply of loanable funds to the left, causing interest rates to rise.

C) demand for loanable funds to the right, causing interest rates to rise.

D) demand for loanable funds to the left, causing interest rates to fall.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a small closed economy investment is $50 billion and private saving is $55 billion. What are public saving and national saving?

A) $60 billion and $5 billion

B) $50 billion and -$5 billion

C) $5 billion and $60 billion

D) -$5 billion and $50 billion

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

By definition, government purchases and taxes are zero for a closed economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Huedepool Beer runs into financial difficulty, the stockholders as

A) part owners of Huedepool are paid before bondholders get paid anything at all.

B) part owners of Huedepool are paid after bondholders get paid.

C) creditors of Huedepool are paid before bondholders get paid anything at all.

D) creditors of Huedepool are paid after bondholders get paid.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The bond market

A) is a financial market, whereas the stock market is a financial intermediary.

B) is a financial intermediary, whereas the stock market is a financial market.

C) is a financial market, as is the stock market.

D) is a financial intermediary, as is the stock market.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in a closed economy GDP is equal to 11,000, taxes are equal to 2,500 consumption equals 7,500 and government purchases equal 2,000. What are private saving, public saving, and national saving?

A) 1,500, 1,000, and 500, respectively

B) 1,000, 500, and 1,500, respectively

C) 500, 1,500, and 1,000, respectively

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a share of stock in Dell sells for $70, the retained earnings per share are $5, and the dividend per share is $2, then the price-earnings ratio is 10.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009 and 2010, the federal government's budget deficit was about

A) 5 percent of GDP, and this was the highest debt-GDP ratio in U.S history.

B) 10 percent of GDP, and this was the highest debt-GDP ratio in U.S history.

C) 5 percent of GDP, and this was the highest debt-GDP ratio since World War II.

D) 10 percent of GDP, and this was the highest debt-GDP ratio since World War II.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm's price-earnings ratio is relatively low, then it might be an indication that

A) the demand for the stock is relatively high.

B) the supply of the stock is relatively low.

C) people expect the firm's earnings to rise.

D) people expect the firm's earnings to fall.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People who buy stock in a corporation such as General Electric become

A) creditors of General Electric, so the benefits of holding the stock depend on General Electric's profits.

B) creditors of General Electric, but the benefits of holding the stock do not depend on General Electric's profits.

C) part owners of General Electric, so the benefits of holding the stock depend on General Electric's profits.

D) part owners of General Electric, but the benefits of holding the stock do not depend on General Electric's profits.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

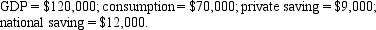

Scenario 8-1. Assume the following information for an imaginary, closed economy.

-Refer to Scenario 8-1. This economy's government is running a

-Refer to Scenario 8-1. This economy's government is running a

A) budget surplus of $3,000.

B) budget surplus of $6,000.

C) budget deficit of $3,000.

D) budget deficit of $6,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Generally, if people begin to expect a company to have higher future profits, the price of the company's stock will begin to decrease.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Public saving is T - G, while private saving is Y - T - C.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, if the government increases transfer payments to households, then the effect of this on the government's budget

A) will make investment rise.

B) will make the rate of interest rise.

C) will make public saving rise.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 473

Related Exams