A) 1.33.

B) 7.

C) 4.

D) 3.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

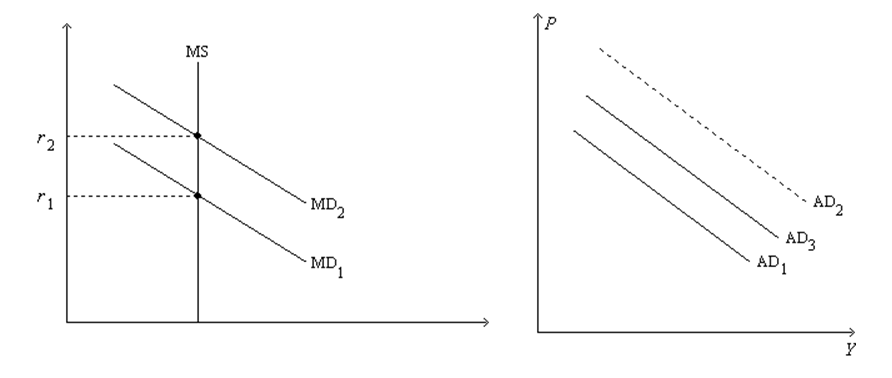

Figure 34-6.On the left-hand graph,MS represents the supply of money and MD represents the demand for money;on the right-hand graph,AD represents aggregate demand.The usual quantities are measured along the axes of both graphs.  -Refer to Figure 34-6.Suppose the multiplier is 5 and the government increases its purchases by $15 billion.Also,suppose the AD curve would shift from AD1 to AD2 if there were no crowding out;the AD curve actually shifts from AD1 to AD3 with crowding out.Also,suppose the horizontal distance between the curves AD1 and AD3 is $55 billion.The extent of crowding out,for any particular level of the price level,is

-Refer to Figure 34-6.Suppose the multiplier is 5 and the government increases its purchases by $15 billion.Also,suppose the AD curve would shift from AD1 to AD2 if there were no crowding out;the AD curve actually shifts from AD1 to AD3 with crowding out.Also,suppose the horizontal distance between the curves AD1 and AD3 is $55 billion.The extent of crowding out,for any particular level of the price level,is

A) $75 billion.

B) $40 billion.

C) $30 billion.

D) $20 billion.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the multiplier is 6 and if there is no crowding-out effect,then a $60 billion increase in government expenditures causes aggregate demand to

A) increase by $250 billion.

B) increase by $333 billion.

C) increase by $360 billion.

D) None of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

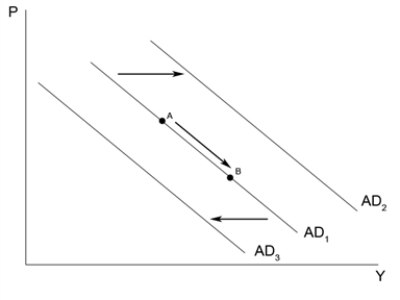

Figure 34-8  -Refer to Figure 34-8.An increase in taxes will

-Refer to Figure 34-8.An increase in taxes will

A) shift aggregate demand from AD1 to AD2.

B) shift aggregate demand from AD1 to AD3.

C) cause movement from point A to point B along AD1.

D) have no effect on aggregate demand.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in government purchases is likely to

A) decrease interest rates.

B) reduce money demand.

C) crowd out investment spending by business firms.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the marginal propensity to consume is 0.75,and there is no investment accelerator or crowding out,a $15 billion increase in government expenditures would shift the aggregate demand curve right by

A) $60 billion,but the effect would be larger if there were an investment accelerator.

B) $60 billion,but the effect would be smaller if there were an investment accelerator.

C) $45 billion,but the effect would be larger if there were an investment accelerator.

D) $45 billion,but the effect would be smaller if there were an investment accelerator.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009 President Obama and Congress increased government spending.Some economists thought this increase would have little effect on output.Which of the following would make the effect of an increase in government expenditures on aggregate demand smaller?

A) the interest rate falls and aggregate supply is relatively flat

B) the interest rate falls and aggregate supply is relatively steep

C) the interest rate rises and aggregate supply is relatively flat

D) the interest rate rises and aggregate supply is relatively steep

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the MPC is 0.8.Assuming only the multiplier effect matters,a decrease in government purchases of $100 billion will shift the aggregate demand curve to the

A) left by $180 billion.

B) left by $500 billion.

C) right by $180 billion.

D) right by $400 billion.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal propensity to consume (MPC) is defined as the fraction of

A) extra income that a household consumes rather than saves.

B) extra income that a household either consumes or saves.

C) total income that a household consumes rather than saves.

D) total income that a household either consumes or saves.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the multiplier is 5.25,then the MPC is

A) 0.19.

B) 0.68.

C) 0.81.

D) 0.84.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As real GDP falls,

A) money demand rises,so the interest rate rises.

B) money demand rises,so the interest rate falls

C) money demand falls,so the interest rate rises.

D) money demand falls,so the interest rate falls.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming no crowding-out,investment-accelerator,or multiplier effects,a $100 billion increase in government expenditures shifts aggregate demand

A) right by more than $100 billion.

B) right by $100 billion.

C) left by more than $100 billion.

D) left by $100 billion.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of an increase in government purchases?

A) The government builds new roads.

B) The Federal Reserve purchases government bonds.

C) The government decreases personal income taxes.

D) The government increases unemployment insurance benefit payments.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tends to make the size of a shift in aggregate demand resulting from an increase in government purchases smaller than it otherwise would be?

A) the multiplier effect

B) the crowding-out effect

C) the accelerator effect

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events shifts aggregate demand rightward?

A) an increase in government expenditures or a decrease in the price level

B) a decrease in government expenditures or an increase in the price level

C) an increase in government expenditures,but not a change in the price level

D) a decrease in the price level,but not an increase in government expenditures

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax increase has

A) a multiplier effect but not a crowding out effect

B) a crowding out effect but not a multiplier effect

C) both a crowding out and multiplier effect

D) neither a multiplier or crowding out effect

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there are both multiplier and crowding out effects but without any accelerator effects.An increase in government expenditures would

A) shift aggregate demand right by a larger amount than the increase in government expenditures.

B) shift aggregate demand right by the same amount as the increase in government expenditures.

C) shift aggregate demand right by a smaller amount than the increase in government expenditures.

D) Any of the above outcomes are possible.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process of the investment accelerator involves

A) positive feedback from aggregate demand to investment.

B) negative feedback from aggregate demand to investment.

C) positive feedback from aggregate supply to investment.

D) negative feedback from aggregate supply to investment.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 34-1.Take the following information as given for a small,imaginary economy: • When income is $10,000,consumption spending is $6,500. • When income is $11,000,consumption spending is $7,250. -Refer to Scenario 34-1.The marginal propensity to consume for this economy is

A) 0.650.

B) 0.750.

C) 0.650 or 0.664,depending on whether income is $10,000 or $11,000.

D) 0.800.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An aide to a U.S.Congressman computes the effect on aggregate demand of a $20 billion tax cut.The actual increase in aggregate demand is less than the aide expected.Which of the following errors in the aide's computation would be consistent with an overestimation of the impact on aggregate demand?

A) The actual MPC was larger than the MPC the aide used to compute the multiplier.

B) The aide thought the tax cut would be permanent,but the actual tax cut was temporary.

C) The increase in income shifted money demand less than the aide had anticipated.

D) The increase in income resulted in investment rising more than the aide had anticipated.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 123

Related Exams