A) financing activities

B) operating activities.

C) investing activities.

D) either financing or investing activities.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows,the cash flows from investing activities section would include

A) receipts from the issuance of capital stock

B) payments for dividends

C) payments for retirement of bonds payable

D) receipts from the sale of investments

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from investing activities,as part of the statement of cash flows,include receipts from the issuance of bonds payable.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

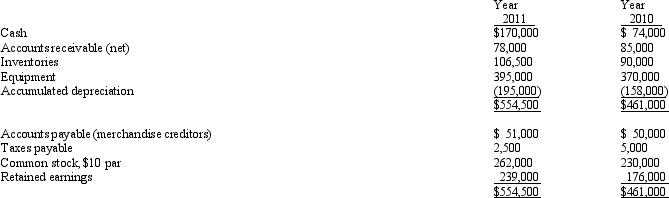

On the basis of the following data for Breach Co.for the year ended December 31,2011 and the preceding year,prepare a statement of cash flows using the indirect method of reporting cash flows from operating activities.

Assume that equipment costing $25,000 was purchased for cash and no long term assets were sold during the period.

Stock was issued for cash - 3,200 shares at par.

Net income for 2010 was $76,000.

Cash dividends declared and paid were $13,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash paid for equipment would be reported in the statement of cash flows in

A) the cash flows from operating activities section

B) the cash flows from financing activities section

C) the cash flows from investing activities section

D) a separate schedule

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

The board of directors declared cash dividends totaling $252,000 during the current year.The comparative balance sheet indicates dividends payable of $48,000 at the beginning of the year and $63,000 at the end of the year.What was the amount of cash payments to stockholders during the year?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows prepared by the indirect method,the cash flows from operating activities section would include

A) receipts from the sale of investments

B) amortization of premium on bonds payable

C) payments for cash dividends

D) receipts from the issuance of capital stock

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows,a $7,500 gain on the sale of fixed assets would be

A) added to net income in converting the net income reported on the income statement to cash flows from operating activities

B) deducted from net income in converting the net income reported on the income statement to cash flows from operating activities

C) added to dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends

D) deducted from dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

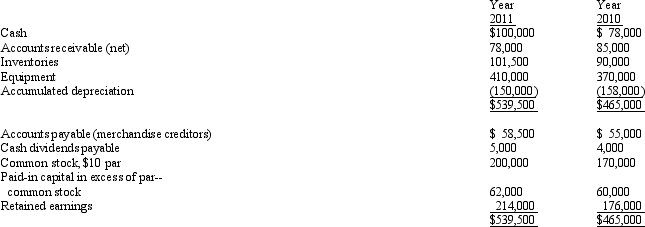

On the basis of the following data for Larson Co.for the year ending December 31,2011 and the preceding year ended December 31,2010,prepare a statement of cash flows.Use the indirect method of reporting cash flows from operating activities.In addition to the balance sheet data,assume that:

Equipment costing $125,000 was purchased for cash.

Equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000.

The stock was issued for cash.

The only entries in the retained earnings account were net income of $51,000 and cash dividends declared of $13,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash dividends paid on capital stock would be reported in the statement of cash flows in

A) the cash flows from financing activities section

B) the cash flows from investing activities section

C) a separate schedule

D) the cash flows from operating activities section

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Net income for the year was $29,500.Accounts receivable increased $2,500,and accounts payable increased $5,400.Under the indirect method,the cash flow from operations is $32,400.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales for the year were $600,000.Accounts receivable were $100,000 and $80,000 at the beginning and end of the year.Cash received from customers to be reported on the cash flow statement using the direct method is

A) $700,000

B) $600,000

C) $580,000

D) $620,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Purchasing equipment by issuing a six-month note should be shown on the statement of cash flows under the investing activities section.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The declaration and issuance of a stock dividend would be reported on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Cost of merchandise sold reported on the income statement was $155,000.The accounts payable balance increased $5,000,and the inventory balance increased by $11,000 over the year.Determine the amount of cash paid for merchandise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The last item on the statement of cash flows prior to the schedule of noncash investing and financing activities reports

A) the increase or decrease in cash

B) cash at the end of the year

C) net cash flow from investing activities

D) net cash flow from financing activities

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

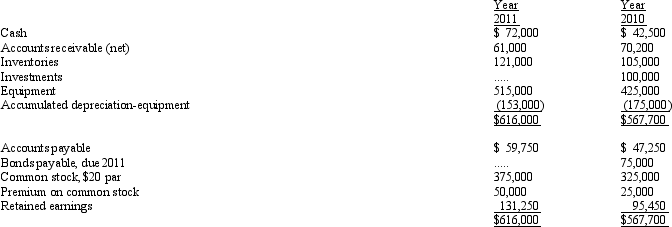

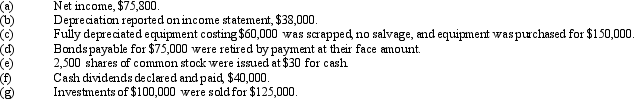

The comparative balance sheet of Barry Company,for 2011 and the preceding year ended December 31,2010,appears below in condensed form:

Additional data for the current year are as follows:

Additional data for the current year are as follows:

Prepare a statement of cash flows using the indirect method.

Prepare a statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows,the cash flows from financing activities section would include

A) receipts from the sale of investments

B) payments for the acquisition of investments

C) receipts from a note receivable

D) receipts from the issuance of capital stock

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Sales reported on the income statement were $372,000.The accounts receivable balance declined $4,500 over the year.The amount of cash received from customers was $367,500.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows prepared by the indirect method,a $50,000 gain on the sale of investments would be

A) deducted from net income in converting the net income reported on the income statement to cash flows from operating activities

B) added to net income in converting the net income reported on the income statement to cash flows from operating activities

C) added to dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends

D) deducted from dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 160

Related Exams