A) the net sales of Companies A and B.

B) Company B's net sales.

C) Company A's net income.

D) Company A's net sales.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's ability to pay current liabilities can be evaluated using the quick ratio and the current ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

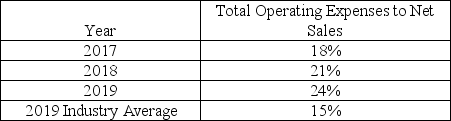

Hull Company reports the following data:  Based on the above data,what can be said about the Hull Company?

Based on the above data,what can be said about the Hull Company?

A) The company is controlling operating expenses.

B) The company is doing better than the industry average.

C) The company is losing control of operating expenses.

D) The company is increasing sales over time.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The leverage ratio is a component of:

A) return on assets under DuPont analysis.

B) return on equity under DuPont analysis.

C) return on sales under DuPont analysis.

D) total asset turnover under DuPont analysis.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

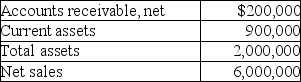

Given the following data:  In vertical analysis,Accounts Receivable,net would be expressed as: (Round your final answer to the nearest whole percent)

In vertical analysis,Accounts Receivable,net would be expressed as: (Round your final answer to the nearest whole percent)

A) 3%.

B) 33%.

C) 10%.

D) 22%.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Trend analysis using income statement data is widely used for predicting the future.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Financial analysis involves more than just looking at financial reports and doing some math.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about financial ratios is FALSE?

A) When calculating return on assets,preferred dividends are subtracted from net income.

B) When calculating return on equity,preferred dividends are subtracted from net income.

C) When calculating the price-earnings ratio,preferred dividends are subtracted from market price per share.

D) When calculating earnings per share,preferred dividends are subtracted from net income.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The quick ratio reflects the company's percentage of total assets financed with debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ratio that measures a company's success in using its assets to earn income for the persons who finance the business is the:

A) leverage.

B) rate of return on total assets.

C) debt ratio.

D) times-interest-earned ratio.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

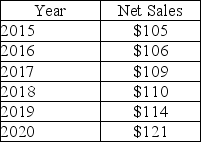

Zemanowski Company reports the following sales figures (in millions) :  What is the trend percentage in 2017 if 2015 is the base year? (Round your final answer to the nearest whole percentage)

What is the trend percentage in 2017 if 2015 is the base year? (Round your final answer to the nearest whole percentage)

A) 109%

B) 101%

C) 104%

D) 105%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marie's Clothing Store had an accounts receivable balance of $420,000 at the beginning of the year and a year-end balance of $580,000.Net credit sales for the year totaled $3,600,000.The average collection period of the receivables was: (Round any intermediary calculations to two decimal places and your final answer to the nearest day. )

A) 43 days.

B) 59 days.

C) 51 days.

D) 8 days.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be most helpful in the comparison of different size companies?

A) horizontal analysis

B) comparison of their net incomes

C) comparison of their working capital balances

D) preparation of common-size financial statements

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has return on assets of 8%.Return on sales are 4%.The leverage ratio is 3.0.Following DuPont analysis,what is return on equity?

A) 4%

B) 8%

C) 24%

D) 12%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Trend percentages are a form of horizontal analysis that are computed only for balance sheet items.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a company has sales of $250 in 2019 and $225 in 2020,the percentage decrease from 2019 to 2020 is 10%.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company can be a risky investment if:

A) cash flows have increased.

B) receivables are being collected early.

C) there is too much debt.

D) inventories are selling too quickly.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An auditors' report by independent accountants (auditors) :

A) gives investors assurance that the company's financial statements conform to GAAP.

B) ensures that the financial statements are error-free.

C) gives investors assurance that the company's stock is a safe investment.

D) is ultimately the responsibility of the management of the client company.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal analysis highlights changes in financial statement line items over time and provides a complete picture of a business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

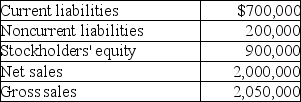

Given the following data:  In vertical analysis,current liabilities would be expressed as: (Round your final answer to the nearest whole percent. )

In vertical analysis,current liabilities would be expressed as: (Round your final answer to the nearest whole percent. )

A) 35%.

B) 39%.

C) 34%.

D) 50%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 120

Related Exams