A) How effectively each company uses leverage to finance its business

B) How much profit each company generates with each dollar of sales

C) How effectively a company collects cash on credit sales

D) How effectively each company uses assets to generate profits

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When comparing a company's results from one year to the next,what kind of information does a company's earnings per share figure provide?

A) Whether the company's total profit has gone up or down

B) Whether the amount of profit generated by one share has gone up or down

C) Whether the market price of a share has gone up or down

D) Whether the company generates more or less profit per sales dollar

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When preparing an annual report,the earnings per share amount is generally shown on a company's income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current ratio is used for which kind of evaluation?

A) The ability of a company to collect its receivables

B) The ability of a company to pay its current liabilities

C) Evaluating shares in a company from an investor's perspective

D) The overall profitability of a company

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benchmarking means comparing a company's financial results to:

A) industry standards or competitors.

B) its budget for the coming year.

C) the expectations of the capital markets.

D) its own results in prior years.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arlington Company has prepared the following common-size income statement to compare its performance with industry averages: Which of the following statements can be correctly concluded from the above data?

A) Arlington achieves better results than the industry by earning higher revenues.

B) Arlington achieves better profitability than the industry, primarily by controlling selling and general expenses more effectively.

C) Arlington's profit is higher than the industry average.

D) Arlington's gross profit per dollar of sales is higher than the industry average.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the definition of vertical analysis?

A) Vertical analysis is the analysis in which percentages are computed by selecting a base year as 100% and expressing amounts for following years as a percentage of the base amount.

B) Vertical analysis is the practice of comparing a company with other companies that are leaders.

C) Vertical analysis is the study of percentage changes in comparative financial statements.

D) Vertical analysis is the analysis of a financial statement that reveals the relationship of each statement item to a specified base, which is the 100% figure.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Arlington Company prepared a common-size income statement to compare its results with its key competitor,Bardo Company.Please refer to the following data: Which of the following statements can be correctly concluded from the above data?

A) Bardo places a higher priority on research and development than Arlington.

B) Bardo's total selling and general expenses are lower than Arlington's.

C) Bardo produces higher gross profit per dollar of sales than Arlington.

D) Bardo Company produced higher total profit than Arlington.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The dividend yield is used for which kind of evaluation?

A) The overall profitability of a company

B) Evaluating shares in a company from an investor's perspective

C) The ability of a company to pay its non-current liabilities

D) The ability of a company to pay its current liabilities

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rate of return on net sales is used for which kind of evaluation?

A) Evaluating shares in a company from an investor's perspective

B) The overall profitability of a company

C) The ability of a company to pay its current liabilities

D) The ability of a company to pay its non-current liabilities

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Oglethorpe Company reports the following information from the vertical analysis of their balance sheet: Current assets: 23) 5 % in 2017 23) 9% in 2016 Which of the following statements could be logically concluded from the above data?

A) The company's ability to pay current liabilities declined.

B) The company's current ratio declined.

C) The company's total current assets declined by 0.4%.

D) The company's current assets declined in proportion to its total assets.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When comparing one company to another,what kind of information does the accounts receivable turnover provide?

A) How well each company manages the financing of its assets

B) How effective each company is at collecting cash from its credit customers

C) How profitable each company is based on the sale of its products

D) How much profit is generated by a share of each company

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

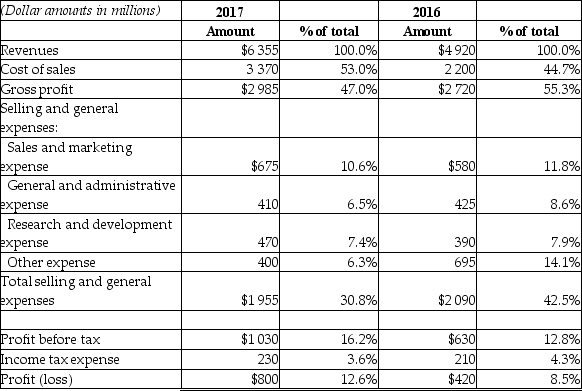

Please refer to the vertical analysis of income statement data shown below:

The figure 8.5% shown for profit in 2016 signifies that:

The figure 8.5% shown for profit in 2016 signifies that:

A) in 2016, Profit is equal to 8.5% times Profit before tax.

B) in 2016, Profit is equal to 8.5% of Revenues.

C) in 2016, Profit is up 8.5% versus the previous year.

D) in 2016, Profit is 8.5% of Gross profit.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT true of benchmarking?

A) It uses vertical analysis as its primary methodology.

B) It is used to compare a company against its competitors.

C) It is used to compare companies of different sizes.

D) It is used to compare a company's results against industry averages.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In a vertical analysis of the income statement,each line item is shown as a percentage of gross profit.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Arlington Company has prepared the following common-size income statement to compare its performance with industry averages: Based on the above data,an analyst could conclude that Arlington's total profit is higher than the industry average.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The debt-to-equity ratio is used for which kind of evaluation?

A) Evaluating shares in a company from an investor's perspective

B) The overall profitability of a company

C) The ability of a company to pay its current liabilities

D) The ability of a company to pay its non-current liabilities

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an analyst wishes to see how sales revenue of a company has changed from one year to the next,which of the following types of financial statement analysis would be used?

A) Ratio analysis

B) Horizontal analysis

C) Common-size financial statement analysis

D) Vertical analysis

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you are comparing your company's results with those of other companies in the industry,the process is called:

A) a horizontal analysis.

B) a trend analysis.

C) sensitivity analysis.

D) benchmarking.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors might suggest that a company is having difficulty selling its inventory?

A) An increase in total debt

B) An increase in receivables

C) An increase in interest expense

D) A buildup of inventory balances

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 117

Related Exams