A) property taxes.

B) property insurance.

C) depreciation on factory equipment.

D) all of the above.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Selected financial information for Greek Food Producers is presented in the following table (000s omitted) .  What was cost of goods sold?

What was cost of goods sold?

A) $1080

B) $1290

C) $750

D) $1280

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

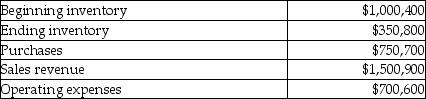

Chicago Steel's operating activities for the year are listed below.  What is the cost of goods sold for the year?

What is the cost of goods sold for the year?

A) $1,400,300

B) $750,200

C) $50,100

D) $1,751,100

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chilton Corporation is analyzing its controllable costs to see where it can save money. Which of the following costs should it ignore during this analysis?

A) employee development

B) factory property insurance

C) employee bonuses

D) advertising

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

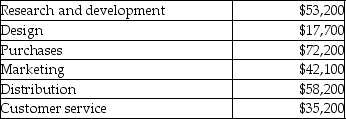

Pink Ribbon Shoppe, a clothing retailer, had the following total costs as grouped by value chain element:  What were the company's period costs?

What were the company's period costs?

A) $206,400

B) $278,600

C) $100,300

D) $135,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of lighting the factory would be classified as ________ when determining the cost of a manufactured product.

A) an indirect cost

B) a direct cost

C) a period cost

D) none of the above

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

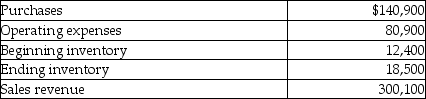

Tuity Fruity Beverage Company's operating activities for the year are listed below.  What is the cost of goods available for sale?

What is the cost of goods available for sale?

A) $140,900

B) $153,300

C) $80,900

D) $134,800

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

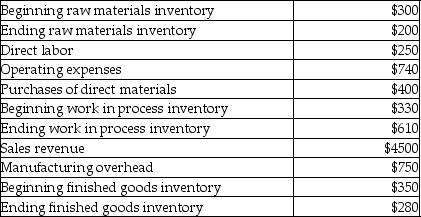

Happy Feet Running Company manufactures running shoes and has the following costs during the past month:  What are prime costs for Happy Feet Running Company for the month?

What are prime costs for Happy Feet Running Company for the month?

A) $124,250

B) $116,250

C) $91,250

D) $85,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company X sells widgets. The following information summarizes the company's operating activities for the year:  What is cost of goods sold?

What is cost of goods sold?

A) $9300

B) $6500

C) $8100

D) $13,700

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has fixed costs of $60,000 per month. If sales double from 6,000 to 12,000 units during the month, fixed costs in total will

A) double.

B) remain the same.

C) be cut in half.

D) be none of the above.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Enter the letter of the type of each company category on the line in front of each statement. Letters may be used more than once or not at all. A. service company B. merchandising company C. manufacturing company ________ generally has no or minimal inventory ________ has three types of inventory ________ has one class of inventory only ________ Ford Motor Company is an example of this company category ________ Wal-Mart is an example of this company category

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Collectively, all costs such as distribution, marketing, and design are part of

A) downstream activities.

B) fixed costs.

C) the value chain.

D) manufacturing costs.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a manufacturer, beginning work in process would be equal to

A) manufacturing costs incurred in the period - ending work in process inventory.

B) cost of goods manufactured - ending work in process inventory + manufacturing costs incurred in the period.

C) ending work in process inventory + manufacturing costs incurred in the period.

D) cost of goods manufactured + ending work in process inventory - manufacturing costs incurred in the period.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Average cost can be used to calculate total cost at a new level of production.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lucky Cow Dairy provided the following expense information for May:  What is the total cost for the customer service category of the value chain?

What is the total cost for the customer service category of the value chain?

A) $82,800

B) $16,400

C) $73,600

D) $10,300

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost of goods manufactured reflects

A) goods sold during the period.

B) goods completed during the period.

C) goods still in the factory at the end of the period.

D) goods not yet started at the end of the period.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The only difference in the balance sheets of various types of businesses (for example, manufacturing vs. service) is

A) current liabilities.

B) current assets.

C) investments.

D) equity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is deciding whether to purchase production equipment that can produce units more quickly than the current equipment. Which of the following costs would be relevant to its decision?

A) The cost of the new equipment

B) The salary of the factory manager

C) The cost of raw materials

D) The original purchase price of the current machinery

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Page's sells books. The following information summarizes the company's operating expenses for the year:  What is cost of goods available for sale?

What is cost of goods available for sale?

A) $117,200

B) $65,500

C) $120,200

D) $102,200

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harper Inc. has fixed costs of $600,000 when it produces 300,000 units. Its total variable costs are $150,000. When Harper Inc. produces 400,000 units, its variable cost per unit will be

A) $2.00.

B) $0.38.

C) $2.50.

D) $0.50.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 318

Related Exams