A) U.S. shareholders are taxable on any income earned by a controlled foreign corporation.

B) U.S. shareholders are never taxable on income earned by a controlled foreign corporation until such income is distributed to the shareholders.

C) U.S. shareholders of a controlled foreign corporation can increase their basis by the amount of any constructive distributions from the corporation.

D) Controlled foreign corporations are taxable in the United States on their worldwide income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The foreign tax credit is available for income taxes paid to a foreign country.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following entities is not subject to U.S. federal income tax?

A) U.S. corporation conducting 100 percent of its business outside the United States

B) Branch of U.S. corporation operating entirely in Germany

C) French subsidiary of U.S. parent operating entirely in France

D) Dutch corporation operating entirely within the United States

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Galaxy Corporation conducts business in the U.S. and in Country X. In which of the following situations will Galaxy not be allowed a foreign tax credit for income taxes paid to Country X?

A) Country X operations are conducted through a domestic subsidiary included in Galaxy's consolidate tax return.

B) Country X operations are conducted through a foreign subsidiary that paid no dividends.

C) Country X operations are conducted through a foreign subsidiary that distributed 100% of its after-tax earnings as a dividend to Galaxy.

D) Country X operations are conducted through a foreign branch.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

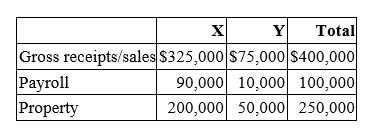

Cambridge, Inc. conducts business in states X and Y. This year, its before-tax income was $150,000. Below is information regarding its sales, payroll, and property factors in both states.  Both states apply an equally-weighted three-factor formula to apportion income. State X has a 10% corporate income tax and state Y has a 5% corporate income tax. Compute the state tax savings if Cambridge could relocate $100,000 of property and $50,000 of payroll from state X to state Y.

Both states apply an equally-weighted three-factor formula to apportion income. State X has a 10% corporate income tax and state Y has a 5% corporate income tax. Compute the state tax savings if Cambridge could relocate $100,000 of property and $50,000 of payroll from state X to state Y.

A) $2,250

B) $12,563

C) $11,532

D) $9,094

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about income tax treaties is false?

A) An income tax treaty is a bilateral agreement between the governments of two countries defining and limiting each country's respective tax jurisdiction.

B) The provisions of income tax treaties pertain only to individuals and corporations that are residents of either treaty country.

C) Under a typical treaty, the non-resident country would only tax a firm's profits if the firm maintained a permanent establishment in that country.

D) Under a typical treaty, a firm's profits would be allocated to the countries in a manner similar to the apportionment of income among states under the UDITPA formula.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about subpart F income is false?

A) Subpart F income is constructively repatriated to U.S. shareholders of a controlled foreign corporation (CFC) when earned.

B) Subpart F income has no commercial or economic connection to the CFC's home country.

C) Subpart F income includes income from the manufacture of goods in the CFC's home country.

D) Subpart F income includes income from the purchase of goods from a related party that are subsequently sold to another related party for use outside the CFC's home country.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Under the U.S. tax system, a domestic corporation pays U.S. tax only on the portion of its business income earned in the United States.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under most tax treaties, income attributable to a permanent establishment through which a foreign taxpayer conducts business can be taxed only by the taxpayer's country of residence.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A bilateral agreement between the governments of England and France defining and limiting each party's respective tax jurisdiction is an example of a tax treaty.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

DFJ, a Missouri corporation, owns 55% of Duvall, a foreign corporation formed under Krunian law. Krunia is a central European country with a 22% corporate income tax and no income tax treaty with the United States. Last year, DFJ leased equipment to Duvall for a $415,000 annual rent payment. DFJ reported the rent as taxable income, while Duvall deducted it in the computation of taxable income. This year, the IRS determined that an arm's length rent for the equipment should be $600,000. The IRS can use its Section 482 authority to:

A) Increase DFJ's taxable income by $185,000 and decrease Duvall's taxable income by $185,000.

B) Increase DFJ's taxable income by $185,000.

C) Require Duvall to pay $185,000 additional rent to DFJ.

D) Require DFJ to recognize a $185,000 constructive dividend from Duvall.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a corporation with a 35% marginal federal income tax rate pays $20,000 state income tax, the after-tax cost of the state tax is $13,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

All states assessing an income tax use the same formula for apportionment purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

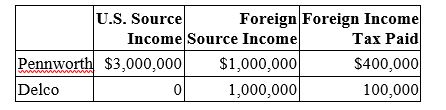

Pennworth Corporation operates in the United States and foreign country M. Its domestic subsidiary Delco, Inc. operates in foreign country N. This year, the two corporations report the following.  If Pennworth and Delco file a consolidated U.S. tax return, compute consolidated income tax liability.

If Pennworth and Delco file a consolidated U.S. tax return, compute consolidated income tax liability.

A) $1,200,000

B) $1,260,000

C) $1,700,000

D) $1,020,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Cross-crediting allows multinational corporations to use excess credits generated in low-tax jurisdictions to offset excess limitations generated in high-tax jurisdictions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chester, Inc., a U.S. multinational, earns income in three foreign countries. Country A has a 25% income tax, Country B has a 35% income tax, and Country C has a 45% income tax. In which of these countries could Chester lower its world-wide tax liability by operating through a foreign subsidiary rather than a domestic subsidiary? Assume the foreign subsidiary will reinvest all after-tax earnings rather than paying dividends.

A) Country A

B) Country B

C) Country C

D) All three countries

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wilmington, Inc., a Pennsylvania corporation, manufactures computer components that it sells to Seine Corporation, a French company, for assembly into finished products. Wilmington owns 90% of Seine's stock. Wilmington's cost per component is $5, its selling price per component is $16, and it sold 110,000 components to Seine this year. Wilmington's taxable income as reported on its Form 1120 was $2,400,000, and Seine's taxable income as reported on its French corporate income tax return was $1,750,000. Determine the effect on the taxable incomes of both corporations if the IRS determines that an arm's length transfer price per component is $23.

A) Taxable income of both corporations will increase by $770,000.

B) Taxable income of both corporations will decrease by $770,000.

C) Wilmington's taxable income will increase by $770,000. Seine's taxable income does not change.

D) Wilmington's taxable income will decrease by $770,000 and Seine's taxable income will decrease by $770,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A U.S. taxpayer can make an annual election to take a credit or a deduction for foreign income taxes paid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

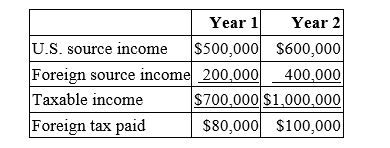

Jenkin Corporation reported the following for its first two taxable years.  Calculate Jenkin's U.S. tax liability for Year 2.

Calculate Jenkin's U.S. tax liability for Year 2.

A) $340,000

B) $240,000

C) $228,000

D) $204,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The United States has jurisdiction to tax income earned by any foreign corporation that is a controlled subsidiary of a U.S. parent corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 107

Related Exams