A) Go short in the spot market, go long in the futures contract.

B) Go long in the spot market, go short in the futures contract.

C) Go short in the spot market, go short in the futures contract.

D) Go long in the spot market, go long in the futures contract.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Today's settlement price on a Chicago Mercantile Exchange (CME) Yen futures contract is $0.8011/¥100. Your margin account currently has a balance of $2,000. The next three days' settlement prices are $0.8057/¥100, $0.7996/¥100, and $0.7985/¥100. (The contractual size of one CME Yen contract is ¥12,500,000) . If you have a long position in one futures contract, the changes in the margin account from daily marking-to-market, will result in the balance of the margin account after the third day to be

A) $1,425.

B) $1,675.

C) $2,000.

D) $3,425.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yesterday, you entered into a futures contract to buy €62,500 at $1.50 per €. Suppose the futures price closes today at $1.46. How much have you made/lost?

A) Depends on your margin balance.

B) You have made $2,500.00.

C) You have lost $2,500.00.

D) You have neither made nor lost money, yet.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For European currency options written on euro with a strike price in dollars, what of the effect of an increase in r$ relative to r€?

A) Decrease the value of calls and puts ceteris paribus

B) Increase the value of calls and puts ceteris paribus

C) Decrease the value of calls, increase the value of puts ceteris paribus

D) Increase the value of calls, decrease the value of puts ceteris paribus

F) A) and D)

Correct Answer

verified

D

Correct Answer

verified

Essay

Find the cost today of your hedge portfolio in pounds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Find the Black-Scholes price of a six-month call option written on €100,000 with a strike price of $1.00 = €1.00. The current exchange rate is $1.25 = €1.00; The U.S. risk-free rate is 5% over the period and the euro-zone risk-free rate is 4%. The volatility of the underlying asset is 10.7 percent.

A) Ce = $0.63577

B) Ce = $0.0998

C) Ce = $1.6331

D) none of the above

F) B) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Draw the tree for a put option on $20,000 with a strike price of £10,000. The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half. The current interest rates are i$ = 3% and are i£ = 2%.

A) ![]()

B) ![]()

C) None of the above

E) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Calculate the current €/£ spot exchange rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

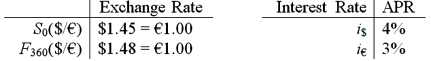

Suppose you observe the following 1-year interest rates, spot exchange rates and futures prices. Futures contracts are available on €10,000. How much risk-free arbitrage profit could you make on 1 contract at maturity from this mispricing?

A) $159.22

B) $153.10

C) $439.42

D) None of the above The futures price of $1.48/€ is above the IRP futures price of $1.4641/€, so we want to sell . ![]() To hedge, we borrow $14,077.67 today at 4%, convert to euro at the spot rate of $1.45/€, invest at 3%. At maturity, our investment matures and pays €10,000, which we sell for $14,800, and then we repay our dollar borrowing with $14,640.78. Our risk-free profit = $159.22 = $14,800 - $14,640.78.

To hedge, we borrow $14,077.67 today at 4%, convert to euro at the spot rate of $1.45/€, invest at 3%. At maturity, our investment matures and pays €10,000, which we sell for $14,800, and then we repay our dollar borrowing with $14,640.78. Our risk-free profit = $159.22 = $14,800 - $14,640.78.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Using your results from parts a and b find the value of this put option (in €). Your answer is worth zero points if it does not include currency symbols (€)!

Correct Answer

verified

Correct Answer

verified

Essay

Find the risk-neutral probability of an "up" move FOR YOUR TREE. Hint: you can't recycle your risk neutral probability from the call option.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Comparing "forward" and "futures" exchange contracts, we can say that

A) delivery of the underlying asset is seldom made in futures contracts.

B) delivery of the underlying asset is usually made in forward contracts.

C) delivery of the underlying asset is seldom made in either contract-they are typically cash settled at maturity.

D) both a and b

E) both a and c

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the event of a default on one side of a futures trade,

A) the clearing member stands in for the defaulting party.

B) the clearing member will seek restitution for the defaulting party.

C) if the default is on the short side, a randomly selected long contract will not get paid. That party will then have standing to initiate a civil suit against the defaulting short.

D) both a and b

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yesterday, you entered into a futures contract to sell €62,500 at $1.50 per €. Your initial performance bond is $1,500 and your maintenance level is $500. At what settle price will you get a demand for additional funds to be posted?

A) $1.5160 per €.

B) $1.208 per €.

C) $1.1920 per €.

D) $1.1840 per €.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most exchange traded currency options

A) mature every month, with daily resettlement.

B) have original maturities of 1, 2, and 3 years.

C) have original maturities of 3, 6, 9, and 12 months.

D) mature every month, without daily resettlement.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

State the composition of the replicating portfolio; your answer should contain "trading orders" of what to buy and what to sell at time zero.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

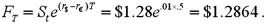

Assume that the dollar-euro spot rate is $1.28 and the six-month forward rate is  The six-month U.S. dollar rate is 5% and the Eurodollar rate is 4%. The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market is

The six-month U.S. dollar rate is 5% and the Eurodollar rate is 4%. The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market is

A) 0 cents.

B) 3.47 cents.

C) 3.55 cents.

D) 3 cents.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

If the call finishes out-of-the-money what is your portfolio cash flow?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which market does a clearinghouse serve as a third party to all transactions?

A) Futures

B) Forwards

C) Swaps

D) None of the above

F) B) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

A European option is different from an American option in that

A) one is traded in Europe and one in traded in the United States.

B) European options can only be exercised at maturity; American options can be exercised prior to maturity.

C) European options tend to be worth more than American options, ceteris paribus.

D) American options have a fixed exercise price; European options' exercise price is set at the average price of the underlying asset during the life of the option.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 100

Related Exams