Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reporting investments at fair value is

A) applicable to share securities only.

B) applicable to debt securities only.

C) applicable to both debt and share securities.

D) a conservative approach because only losses are recognized.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

On January 1, Kingman Corporation purchased a 40% equity in Lewis Company for $360,000. At December 31, Lewis declared and paid a $40,000 cash dividend and reported net income of $98,000. Prepare the necessary journal entries for Kingman Corporation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Desmond Corporation owns 3,500 of the 10,000 outstanding ordinary shares of Wetmore Corporation. During 2014, Wetmore earned £2,400,000 and paid cash dividends of £800,000. How much investment revenue should Desmond report in 2014?

A) £800,000.

B) £840,000.

C) £560,000.

D) £2,400,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

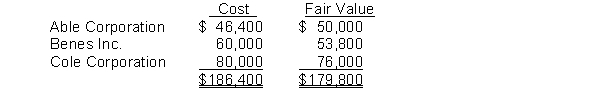

At the end of its first year, the trading securities portfolio consisted of the following ordinary shares.  In the following year, the Benes ordinary shares are sold for cash proceeds of $58,000. The gain or loss to be recognized on the sale is a

In the following year, the Benes ordinary shares are sold for cash proceeds of $58,000. The gain or loss to be recognized on the sale is a

A) gain of $4,200.

B) loss of $2,000.

C) gain of $2,200.

D) loss of $400.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Short-term share investments should be valued on the statement of financial position at

A) the lower of cost or fair value.

B) the higher of cost or fair value.

C) cost.

D) fair value.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Not Answered

Fair Value Adjustment is a valuation ______________ account which is ______________ to (from) the cost of the investments.

Correct Answer

verified

Correct Answer

verified

True/False

Consolidated financial statements should be prepared only when a subsidiary company has a controlling interest in the parent company.

B) False

Correct Answer

verified

Correct Answer

verified

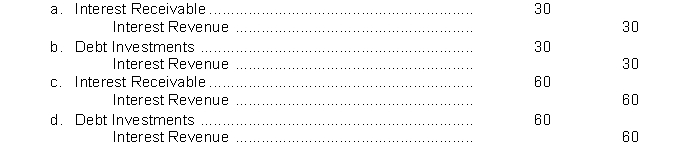

Short Answer

On January 1, Burkett Company purchased as an investment a $1,000, 6% bond for $1,000. The bond pays interest on January 1 and July 1. What is the entry to record the interest accrual on December 31?

Correct Answer

verified

Correct Answer

verified

True/False

Unrealized gains and losses on non-trading securities are reported as a separate component of equity on the statement of financial position.

B) False

Correct Answer

verified

Correct Answer

verified

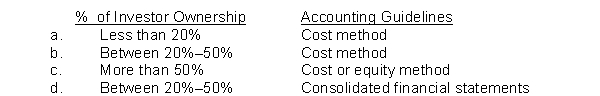

Short Answer

Which of the following is the correct matching concerning the appropriate accounting for long-term share investments?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nagen Company had these transactions pertaining to share investments: Feb. 1 Purchased 2,000 shares of Horton Company (10%) for ₤34,000 cash. June 1 Received cash dividends of ₤2 per share on Horton shares. Oct) 1 Sold 800 Horton shares for ₤15,600. The entry to record the purchase of the Horton shares would include a

A) credit to Share Investments for ₤34,000.

B) credit to Cash for ₤30,000.

C) debit to Share Investments for ₤34,000.

D) debit to Investment Revenue for ₤4,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

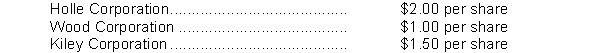

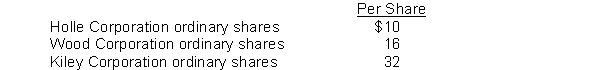

On January 5, 2014, Reiley Company purchased the following share securities as a long-term investment:

300 ordinary shares Holle Corporation for $4,200.

500 ordinary shares Wood Corporation for $10,000.

600 ordinary shares Kiley Corporation for $19,800.

Assume that Reiley Company cannot exercise significant influence over the activities of the investee companies and that the cost method is used to account for the investments.

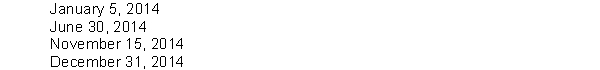

On June 30, 2014, Reiley Company received the following cash dividends:  On November 15, 2014, Reiley Company sold 200 shares of Kiley Corporation for $7,500.

On December 31, 2014, the fair value of the securities held by Reiley Company is as follows:

On November 15, 2014, Reiley Company sold 200 shares of Kiley Corporation for $7,500.

On December 31, 2014, the fair value of the securities held by Reiley Company is as follows:  Instructions

Prepare the appropriate journal entries that Reiley Company should make on the following dates:

Instructions

Prepare the appropriate journal entries that Reiley Company should make on the following dates:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tolan Co. purchased 60, 6% Irick Company bonds for $60,000 cash. Interest is payable semiannually on July 1 and January 1. If 30 of the securities are sold on May 1 for $31,000 plus accrued interest, the entry would include a credit to Gain on Sale of Debt Investments for

A) $2,000.

B) $1,200.

C) $2,200.

D) $1,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

The following transactions were made by Waite Company. Assume all investments are short-term and are readily marketable. June 2 Purchased 300 ordinary shares of Dolen Corporation for $45 per share. July 1 Purchased 200 Oslo Corporation bonds for $220,000. 30 Received a cash dividend of $2 per share from Dolen Corporation. Sept. 15 Sold 90 shares of Dolen Corporation for $50 per share. Dec. 31 Received semiannual interest check for $11,000 from Oslo Corporation. 31 Received a cash dividend of $2 per share from Dolen Corporation. Instructions Journalize the transactions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Short-term investments are listed on the statement of financial position immediately above

A) cash.

B) inventory.

C) accounts receivable.

D) prepaid expenses.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a true statement regarding short-term debt investments?

A) The securities usually pay interest.

B) Investments are frequently government or corporate bonds.

C) This type of investment must be currently traded in the securities market.

D) Debt investments are recorded at the price paid less brokerage fees.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true regarding the Fair Value Adjustment - Trading account?

A) It is a valuation allowance account.

B) It allows the investment account to maintain a record of the investment cost.

C) It should have a credit balance.

D) Its balance is carried forward to future accounting periods.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following reasons best explains why a company that experiences seasonal fluctuations in sales may purchase investments in debt or share securities?

A) The company may have excess cash.

B) The company may generate a significant portion of its earnings from investment income.

C) The company may invest for the strategic reason of establishing a presence in a related industry.

D) The company may invest for speculative reasons to increase the value in pension funds.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in the Unrealized Loss-Equity account will

A) appear on the statement of financial position as a contra asset.

B) appear on the income statement under Other income and expense.

C) appear as a deduction in the equity section.

D) not be shown on the financial statements until the securities are sold.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 227

Related Exams