A) 100

B) 200

C) 400

D) 800

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

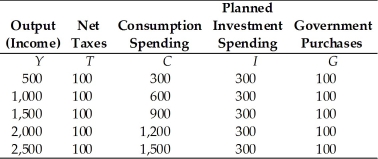

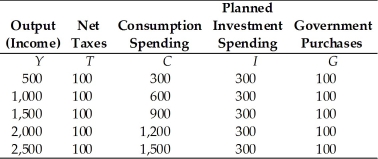

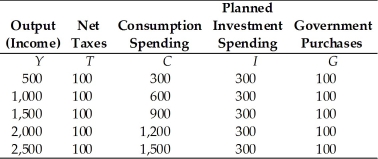

Refer to the information provided in Table 24.4 below to answer the question(s) that follow.

Table 24.4  -Refer to Table 24.4. At an output level of $1,500, disposable income is

-Refer to Table 24.4. At an output level of $1,500, disposable income is

A) $300.

B) $600.

C) $900.

D) $1,200.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When the MPC is 0.8 and t is 0.4, then the government spending multiplier is about -1.54.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Personal taxes are the ________ in the government's budget.

A) smallest expenditure source

B) largest expenditure source

C) smallest revenue source

D) largest revenue source

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During a recession, unemployment ________, tax revenue ________, and the budget deficit ________.

A) rises; falls; rises

B) rises; rises; falls

C) falls; rises; rises

D) falls; falls; rises

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the information provided in Table 24.4 below to answer the question(s) that follow.

Table 24.4  -Refer to Table 24.4. At an output level of $1,500 billion, the level of aggregate expenditure is ________ billion.

-Refer to Table 24.4. At an output level of $1,500 billion, the level of aggregate expenditure is ________ billion.

A) $1,300

B) $1,400

C) $1,500

D) $1,600

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The formula for the tax multiplier is

A) -(MPS/MPC) .

B) MPS/MPC.

C) -(MPC/MPS) .

D) -1/MPS.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

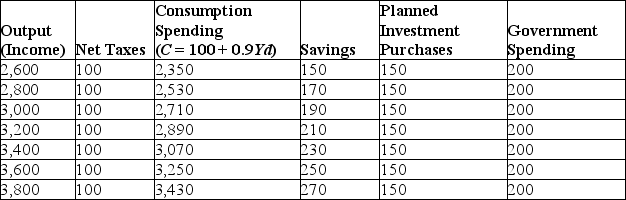

Refer to the information provided in Table 24.8 below to answer the question(s) that follow.

Table 24.8

All Figures in Billions of Dollars

-Refer to Table 24.8. The equilibrium level of income is

-Refer to Table 24.8. The equilibrium level of income is

A) $2,000 billion.

B) $3,400 billion.

C) $3,600 billion.

D) $3,800 billion.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the MPS is 0.1, the tax multiplier is

A) 10.

B) -5.

C) -9.

D) -10.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The tax multiplier is a negative multiplier.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax multiplier is

A) the ratio of the change in taxes to the change in the equilibrium level of output.

B) the MPC multiplied by the MPS.

C) the difference in taxes multiplied by the change in the equilibrium level of output.

D) the ratio of the change in the equilibrium level of output to the change in taxes.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that in the United States the actual deficit is $300 billion. If the United States were at full employment, the deficit would be $100 billion. The structural deficit in the United States is

A) $100 billion.

B) $200 billion.

C) $300 billion.

D) $400 billion.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are hired by the Bureau of Economic Analogies (BEA) as an economic consultant. The chairperson of the BEA tells you that he believes the current unemployment rate is too high. The unemployment rate can be reduced if aggregate output increases. He wants to know what policy to pursue to increase aggregate output by $500 billion. The best estimate he has for the MPC is 0.7. Which of the following policies should you recommend?

A) Decrease government spending by $75 billion.

B) Reduce taxes by $214.3 billion.

C) Reduce taxes by $314.3 billion and to decrease government spending by $500 billion.

D) Reduce the budget deficit by $300 billion.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the tax multiplier is -4 and taxes are reduced by $35 billion, output

A) falls by $8.75 billion.

B) falls by $140 billion.

C) increases by $140 billion.

D) increases by $8.75 billion.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the MPC is 0.8, the tax multiplier is

A) -8.

B) -5.

C) -4.

D) -1.2.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are hired by the Bureau of Economic Analogies (BEA) as an economic consultant. The Chairperson of the BEA tells you that he believes the current unemployment rate is too low. The unemployment rate can be increased if aggregate output decreases. He wants to know what policy to pursue to decrease aggregate output by $50 billion. The best estimate he has for the MPC is 0.9. Which of the following policies should you recommend?

A) decrease government spending by $5 billion

B) decrease government spending by $50 billion

C) increase taxes by $5 billion

D) cut taxes by $10 billion and to increase government spending by $5 billion

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If planned injections are less than leakages, output will

A) decrease.

B) increase.

C) remain constant.

D) either increase or decrease.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of an automatic stabilizer is

A) the food stamp program.

B) changing the tax laws to increase the marginal tax rates.

C) the indexation of social security benefits to the consumer price index.

D) the interest the government pays on loans.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If taxes depend on income and the MPC is 0.6 and t is 0.3, the tax multiplier is

A) -1.03.

B) -1.72.

C) -2.0.

D) -2.24.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the information provided in Table 24.4 below to answer the question(s) that follow.

Table 24.4  -Refer to Equation 24.4. At equilibrium, leakages in Peru equal

-Refer to Equation 24.4. At equilibrium, leakages in Peru equal

A) 2,040.

B) 1,560.

C) 1,440.

D) 960.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 360

Related Exams