A) each country's consumption possibilities are the same as its production possibilities

B) equilibrium is attained with the maximum gains from specialization and trade

C) equilibrium is attained with the maximum amount of international trade

D) a nation has such a high standard of living that there are technically no poor people

E) a nation is governed by an individual with absolute authority

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary difference between an import tariff and an import quota is that

A) tariffs cause prices to rise, but quotas do not

B) quotas cause prices to rise, but tariffs do not

C) tariffs result in a net welfare loss, but quotas do not

D) quotas result in a net welfare loss, but tariffs do not

E) tariff revenues go to government, but quotas benefit those with the right to sell foreign goods domestically

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

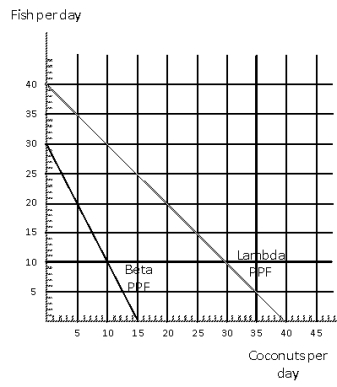

Exhibit 19-1  -Exhibit 19-1 shows the production possibilities frontiers for the countries of Lambda and Beta for fish and coconuts. What is the opportunity cost of a coconut in Lambda?

-Exhibit 19-1 shows the production possibilities frontiers for the countries of Lambda and Beta for fish and coconuts. What is the opportunity cost of a coconut in Lambda?

A) 1/2 fish

B) 1 fish

C) 2 fish

D) 21/2 fish

E) cannot tell from the information provided

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To maximize worldwide gains from trade, the country that should produce a good is the country that

A) has the lowest opportunity cost of producing it

B) can produce that good using the fewest resources

C) will produce that good using the most expensive resources

D) has the most desire for that good

E) has produced that good in the past

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between a specific tariff and an ad valorem tariff is that a specific tariff

A) is a set amount of money per unit of a product, while an ad valorem tariff is a set percentage of product price

B) is a set percentage of product price, while an ad valorem tariff is a set amount of money per unit of a product

C) names a particular good to which the tariff applies, while an ad valorem tariff applies to large classes of products

D) applies only to imports, while an ad valorem tariff applies only to exports

E) sets a strict quota limit on the amount one individual can purchase, while an ad valorem tariff sets no such limit

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The World Trade Organization (WTO)

A) members are required to eliminate tariffs and customs duties

B) supervises trade in merchandise and in services

C) supervises merchandise trade only

D) members are required to eliminate ad valorem tariffs but not specific tariffs

E) includes all nations with populations greater than 10 million, with the exception of North Korea and Cuba

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

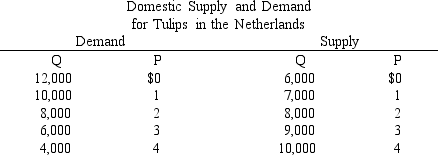

Exhibit 19-4

-In Exhibit 19-4, if the world price of tulips is $4 and there are no trade restrictions, The Netherlands will

-In Exhibit 19-4, if the world price of tulips is $4 and there are no trade restrictions, The Netherlands will

A) produce 10,000, consume 4,000, and import 6,000 tulips

B) produce 10,000 and consume 10,000 tulips

C) produce no tulips

D) import all of the tulips that it consumes

E) consume only some of the tulips it produces

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tina Makumbi imports sesame oil from Ethiopia and sells to a market that has a downward sloping demand curve.The demand curve indicates that some consumers are willing to pay $1.50 or more per pound for the first few pounds, but every consumer gets to buy at the market clearing price of $0.50 per pound. The difference between the most that consumers would pay and the actual amount they do pay is called

A) exporter surplus

B) trade balance

C) producer surplus

D) consumer equilibrium

E) consumer surplus

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For each watch Denmark produces, it gives up the opportunity to make 50 pounds of cheese. Germany can produce one watch for every 100 pounds of cheese it produces. Which of the following is true concerning comparative advantage between the two countries?

A) Denmark has the comparative advantage in watches and cheese.

B) Germany has the comparative advantage in watches and cheese.

C) Germany has the comparative advantage in watches.

D) Denmark has the comparative advantage in watches.

E) Denmark has the comparative advantage in cheese.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For each watch Denmark produces, it gives up the opportunity to make 50 pounds of cheese. Germany can produce one watch for every 100 pounds of cheese it produces. Which of the following is true with regard to opportunity costs in the two countries?

A) The opportunity cost of producing watches is lower in Denmark.

B) The opportunity cost of producing cheese is lower in Denmark.

C) The opportunity cost of producing watches is identical in both countries.

D) It is impossible to compare opportunity costs because the two countries use different currencies.

E) In Germany the opportunity cost of producing one pound of cheese is one watch.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true concerning the impact of tariffs and quotas?

A) Tariffs raise the price of a good but quotas do not.

B) Tariffs reduce consumer and producer surplus whereas quotas reduce domestic consumer surplus and increase domestic producer surplus.

C) Both tariffs and quotas increase the quantity demanded.

D) The revenue resulting from a tariff goes to the government whereas the revenue resulting from a quota goes to whoever is awarded the right to sell the product.

E) The potential welfare loss is greater with tariffs than quotas.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The world price of a good is

A) the price paid by consumers in all nations

B) the price at which it is traded internationally

C) the price paid in U.S. dollars

D) the price paid in foreign currency

E) the terms of trade for each nation

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Dumping refers to selling a commodity abroad at a price that is below its cost of production or below the price charged in the domestic market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to some economists, the protection granted to infant industries should be

A) terminated after one year.

B) for new firms that eventually would develop significant economies of scale in their production processes

C) restricted to firms that face little competition

D) based on current absolute advantage

E) permanent

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms in a high-wage nation such as the U.S. can compete effectively with imports from low-wage nations if

A) skill levels are identical in the nations

B) the U.S. reduces tariffs on imports

C) low-wage nations impose tariffs on U.S. made goods

D) labor productivity is higher in the low-wage nation

E) labor productivity is higher in the U.S.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

U.S. auto workers sometimes experience structural unemployment because of the popularity of foreign cars. Which argument is a labor union most likely to present to Congress when it lobbies for trade restrictions?

A) national defense argument

B) infant industry argument

C) antidumping argument

D) loss of domestic jobs argument

E) declining industry argument

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best expresses the benefit from international trade?

A) With trade, each country can concentrate on producing those goods and services that it produces most efficiently.

B) With trade, a country can increase its political involvement on a global scale.

C) Increased U.S. trade would improve high-tech exports but not agricultural exports.

D) Increased trade would increase U.S. exports and decrease U.S. imports.

E) Increased trade implies that exports of goods and services will always equal imports of goods and services.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

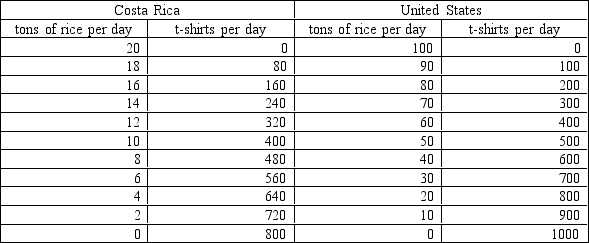

Exhibit 19-2

-In Exhibit 19-2, the United States has a comparative advantage in the production of rice.

-In Exhibit 19-2, the United States has a comparative advantage in the production of rice.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

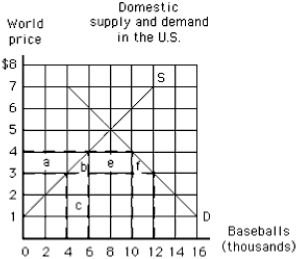

Exhibit 19-6  -In Exhibit 19-6, if the world price of a baseball is $3 and a tariff of $1 per baseball is imposed in the United States, which area represents the United States' net loss as a result of the tariff?

-In Exhibit 19-6, if the world price of a baseball is $3 and a tariff of $1 per baseball is imposed in the United States, which area represents the United States' net loss as a result of the tariff?

A) a + b + c + e

B) b + c + e

C) b + c

D) c + e

E) b + f

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true of declining industries?

A) Job loss is not a problem in a declining industry because the workers can easily find jobs in expanding industries.

B) Jobs may be lost by declining industries but new jobs are created in expanding industries.

C) Over 60 million new jobs have been created in the United States since 1960.

D) One way to solve the problems posed by declining industries is for the government to fund programs to retrain workers for jobs that are in greater demand.

E) One way to solve the problems posed by declining industries is for the government to offer wage subsidies or special tax breaks that decline over time.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 172

Related Exams